How do I automate grid trading strategies on spot grid crypto trading bot?

Our crypto trading bot is a powerful, straightforward-to-use automated trading tool with seven different strategy modes. Spot grid mode enables you to set a manual price range or use a back-tested AI strategy according to which the trading bot will execute automated buys and sells. The bot is designed to buy at lower prices and sell at higher prices, aiming to generate potential profits without the need for active management. The grid trading bot can be particularly handy for high-volatility assets in bullish markets.

What are trading bots?

Trading bots, or automated trading systems, are computer programs designed to execute trades on your behalf. They operate based on pre-programmed algorithms and strategies, allowing you to automate your trading activities. Through cutting-edge technology, these bots can analyze market data, detect trends, and execute trades with precision and speed, without constant manual supervision.

One of the key advantages of trading bots is their ability to eliminate constraints typically associated with human traders. With trading bots, worries about fear of missing out, fatigue, and human error can be reduced. The tool can tirelessly monitor multiple markets, process vast amounts of data, and execute trades instantaneously, making sure you never miss a potential growth opportunity.

How do spot grid trading bots work?

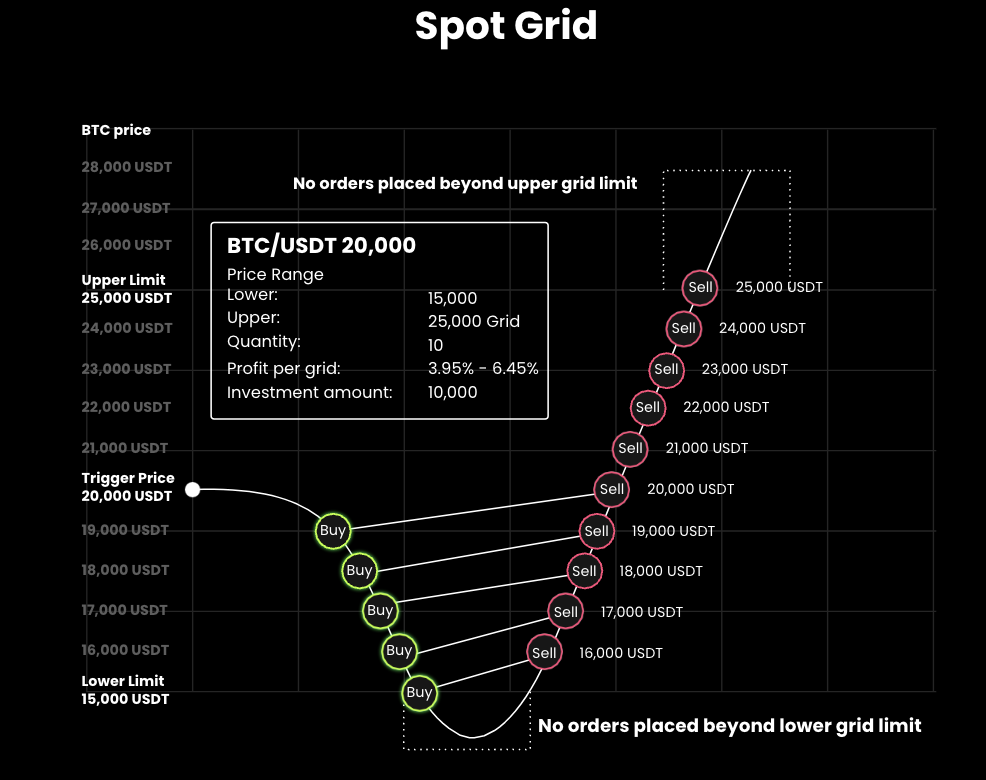

Spot grid mode splits your starting capital between the two assets of your chosen trading pair. It then creates a grid of price points between the upper and lower bounds, and divides your starting funds equally between the number of grids used.

Each time the price reaches the upper grid line, the bot automatically sells a portion of the asset. The bot automatically buys the traded asset when the price reaches the lower grid line. The trader profits from the difference between the buys and sells executed as the price swings.

Example: a user wants to capture opportunities from BTC's price volatility (which stands at 20,000 at the time of this graphic).

Within the spot grid settings, the user sets the lower limit at 15,000 and upper limit at 25,000, placing the bot trade entry within the middle of the lower and upper limit.

The bot will split up the trades equally across the Buy and Sells position, where Buy = USDT and Sells = BTC.

When BTC moves downwards, the bot buys at every grid that allows a 4-6% profit (+-).

When BTC trends upwards, the bot sells at the set profit percentage, until all buy positions are sold.

How can I automate trades using the spot grid trading bot?

To access the spot grid crypto trading bot, navigate to the home page and select Trade

Select Trading bots before selecting Grid bots

Within the three available options under Grid bots, select Spot Grid to access the settings and configuration for spot grid trading

How do I use the spot grid’s AI feature?

You can easily utilize our back-tested AI feature in the Spot Grid trading bot. This feature automates the selection of grid parameters based on historical price data, simplifying the setup process and optimizing your trading experience.

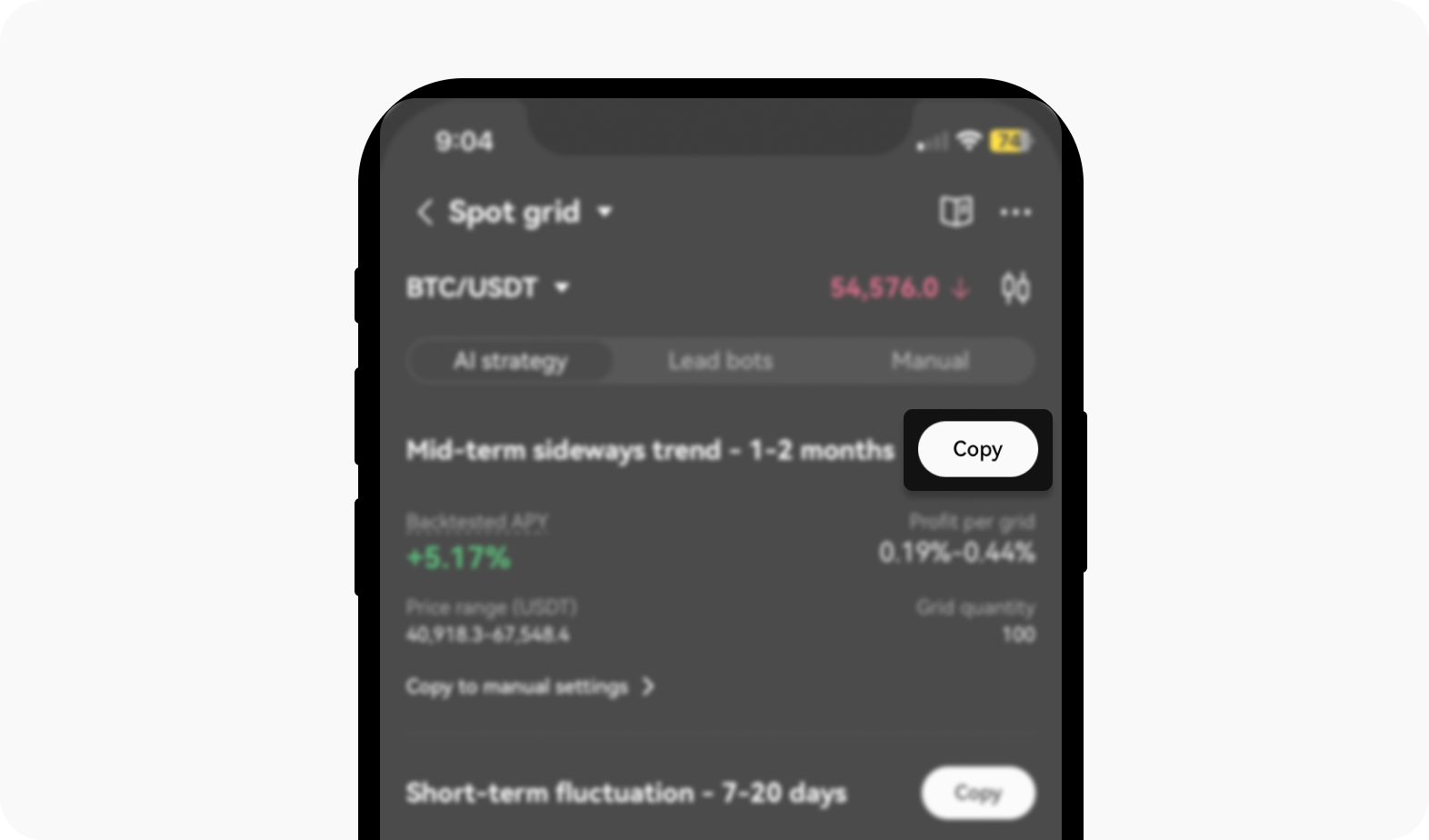

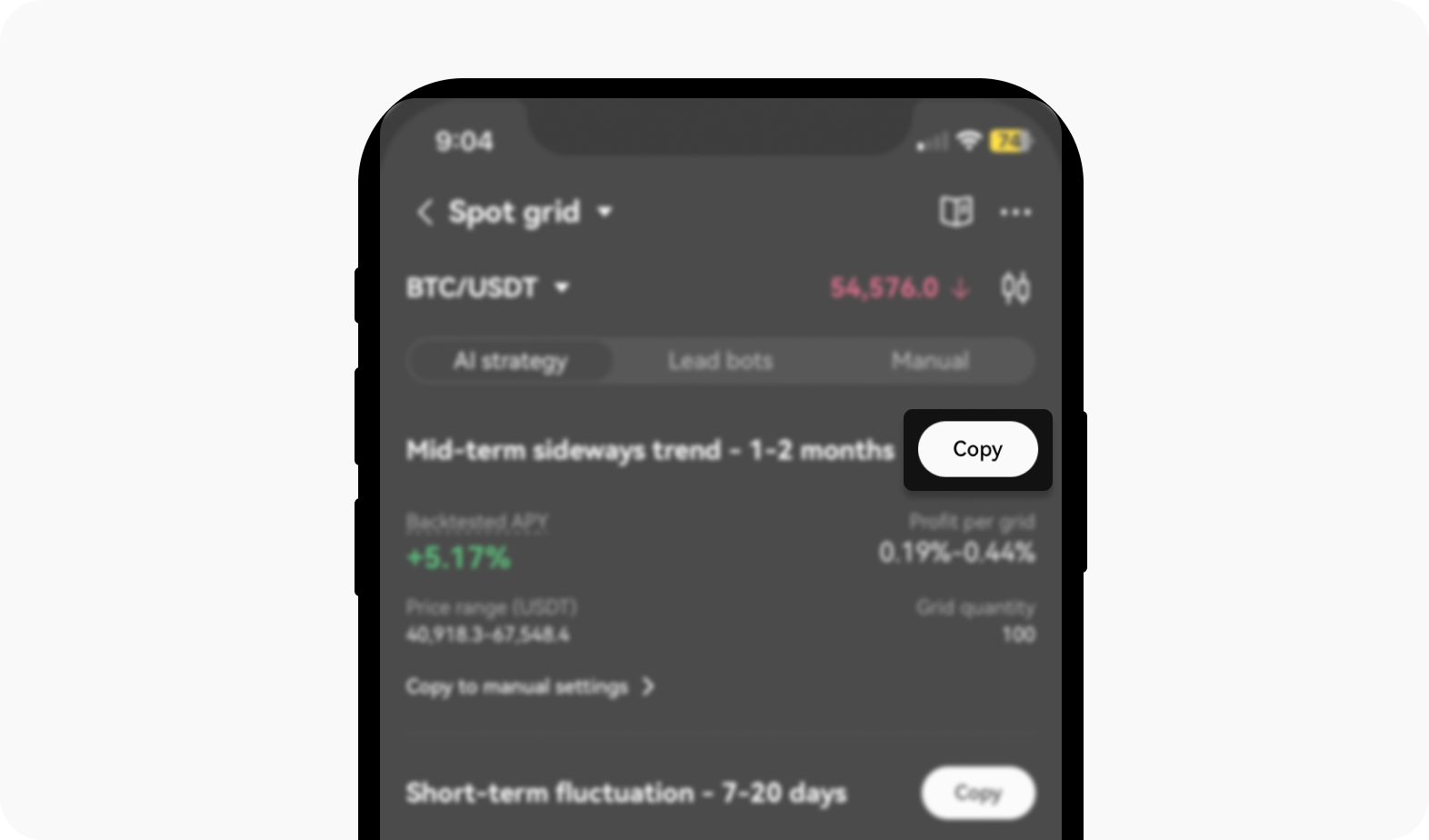

Within the Spot Grid trading bot, locate the option labeled AI strategy and select it

Select the desired strategy duration from the available options: Short-term, Mid-term, or Long-term. This selection will determine the time frame for which the AI strategy will generate the grid parameters. After selecting the strategy duration, select Copy to apply the AI-generated parameters to your Spot Grid configuration

Copy any AI-generated parameters that you prefer under the AI strategy option

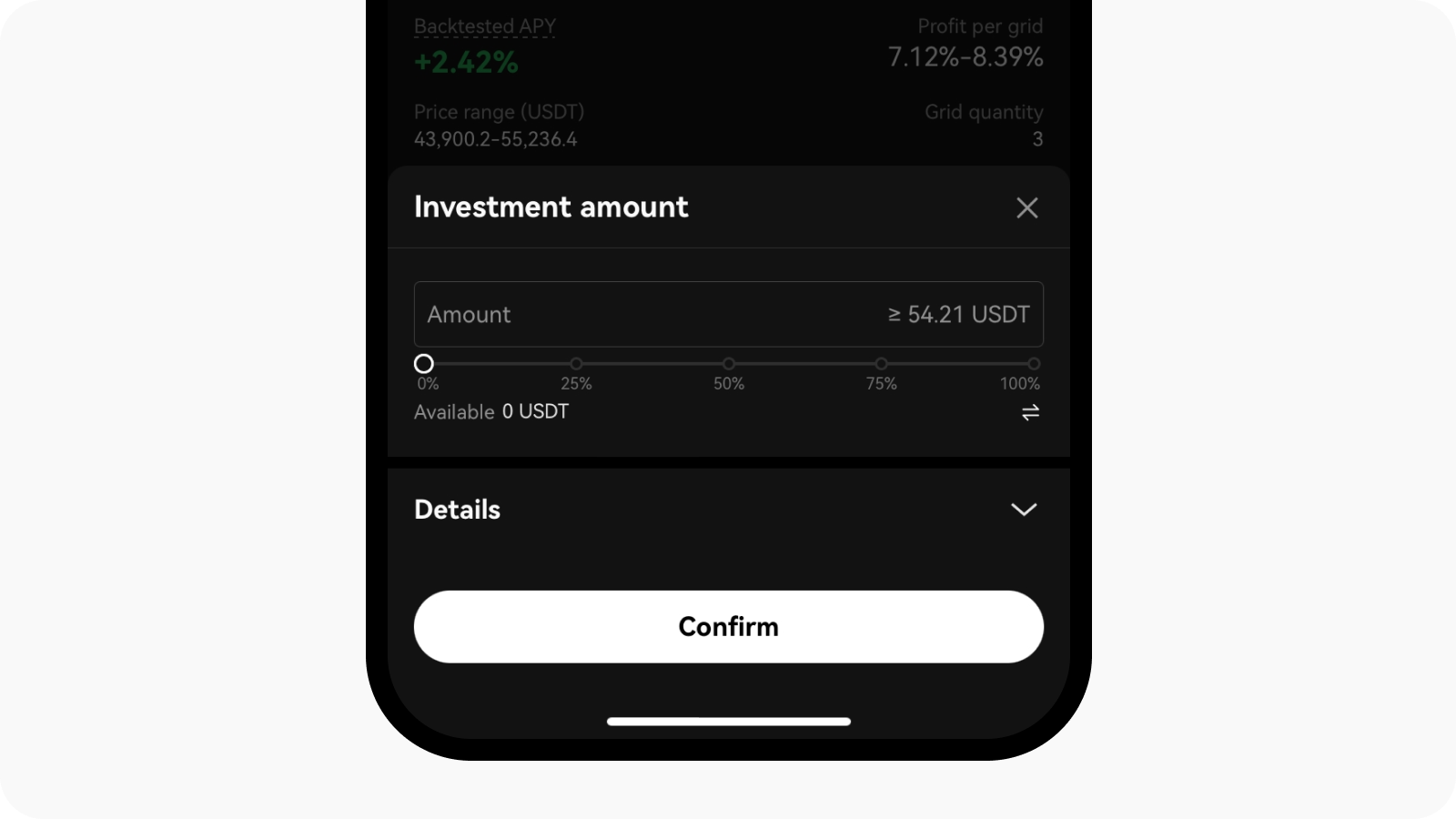

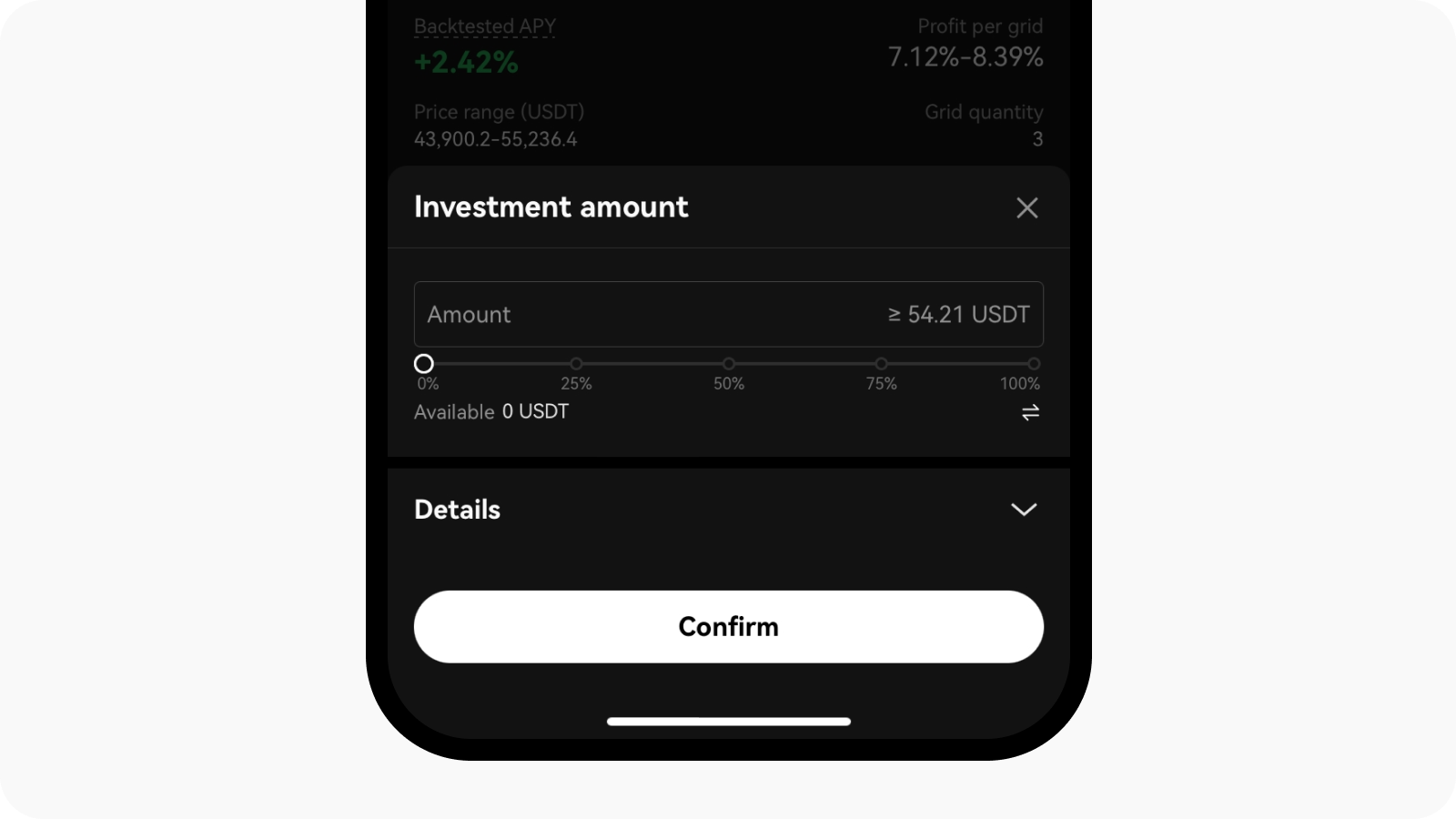

Input your desired trading amount and select Confirm

Adjust your investment amount accordingly and confirm to proceed

How can I take my spot grid to the next level with trailing settings?

What's trailing settings?

Trailing settings are an advanced feature that can take the power of our spot grid trading bot to new heights. With trailing settings, you can automatically adjust the grid upwards or downwards, to keep your trades aligned with market movements. This feature enhances your trading strategy to perform optimally in diverse market conditions, including rising and falling markets, not limited to sideways only.

When do I use trailing settings?

Trailing settings can be particularly beneficial in volatile markets where prices can rapidly move up or down. It enables you to capture opportunities and adapt your trading strategy to changing market conditions. Whether you're navigating a bullish run or a bearish trend, trailing settings empower you to make the most of every price swing.

Example: imagine a scenario where the market experiences a strong upward movement. With trailing settings, you can enable trailing up to set your initial grid range and let the bot automatically adjust the grid upwards as the price rises. This allows you to take advantage of profit from upward momentum, capturing gains at each grid level and maximizing your growth potential.

On the flip side, in a market downturn, enabling trailing down will adjust the grid downwards, allowing you to take advantage of falling prices. By automatically adjusting your grid range, you can strategically enter buy positions at lower levels and sell positions at optimal points, maximizing profitability even in bearish conditions.

Trailing settings empowers you to adapt to market dynamics, capitalize on price movements, and unlock greater profit potential. It can be a game-changer for traders looking to stay ahead in any market situation.

How do I use trailing settings in the spot grid trading bot?

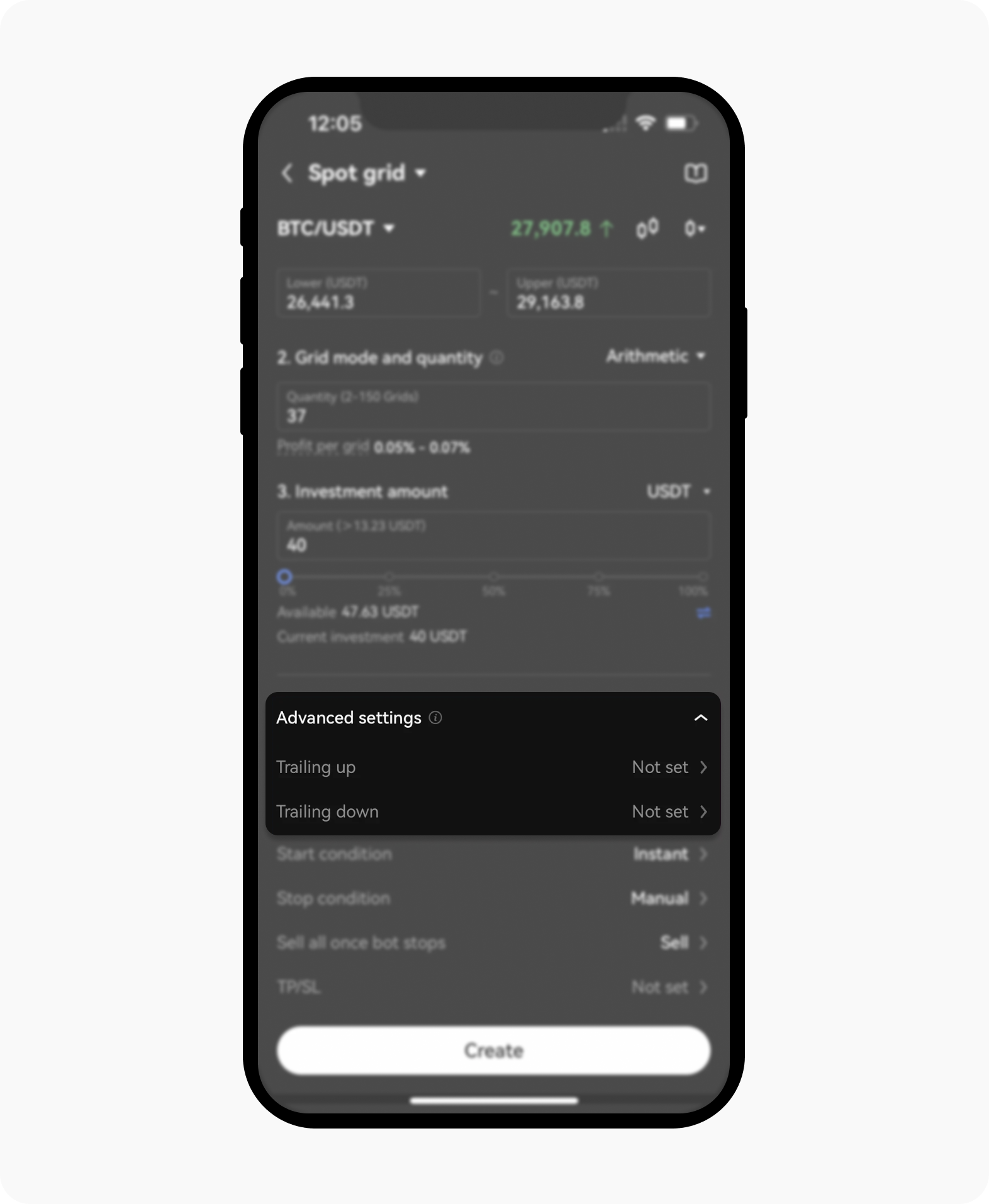

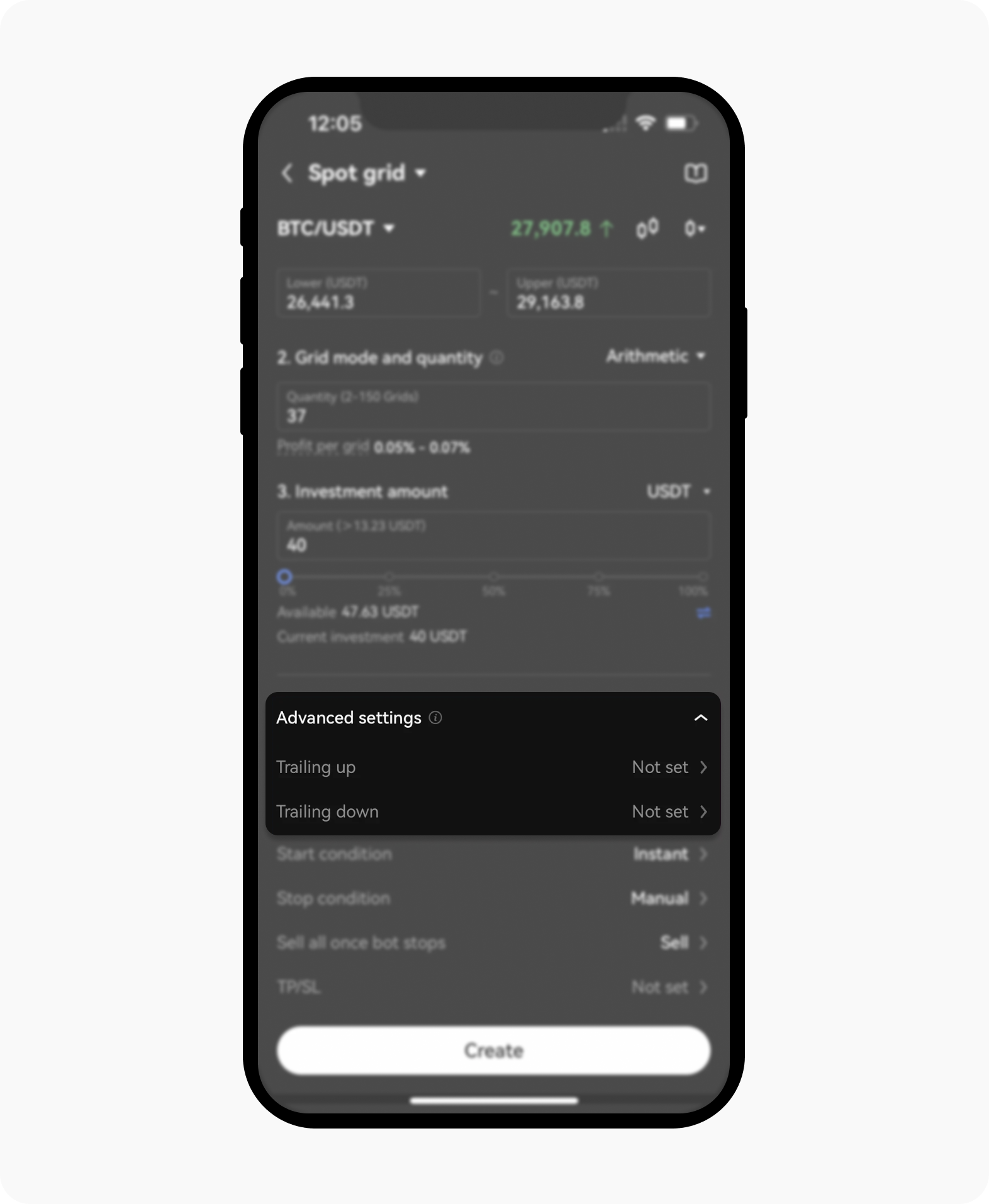

Start by creating a spot grid in the trading bot section. Scroll down to the advanced settings section, where you'll find the trailing up and trailing down options. Select Not set to access the popup window

Set the trailing details under the Advanced setting

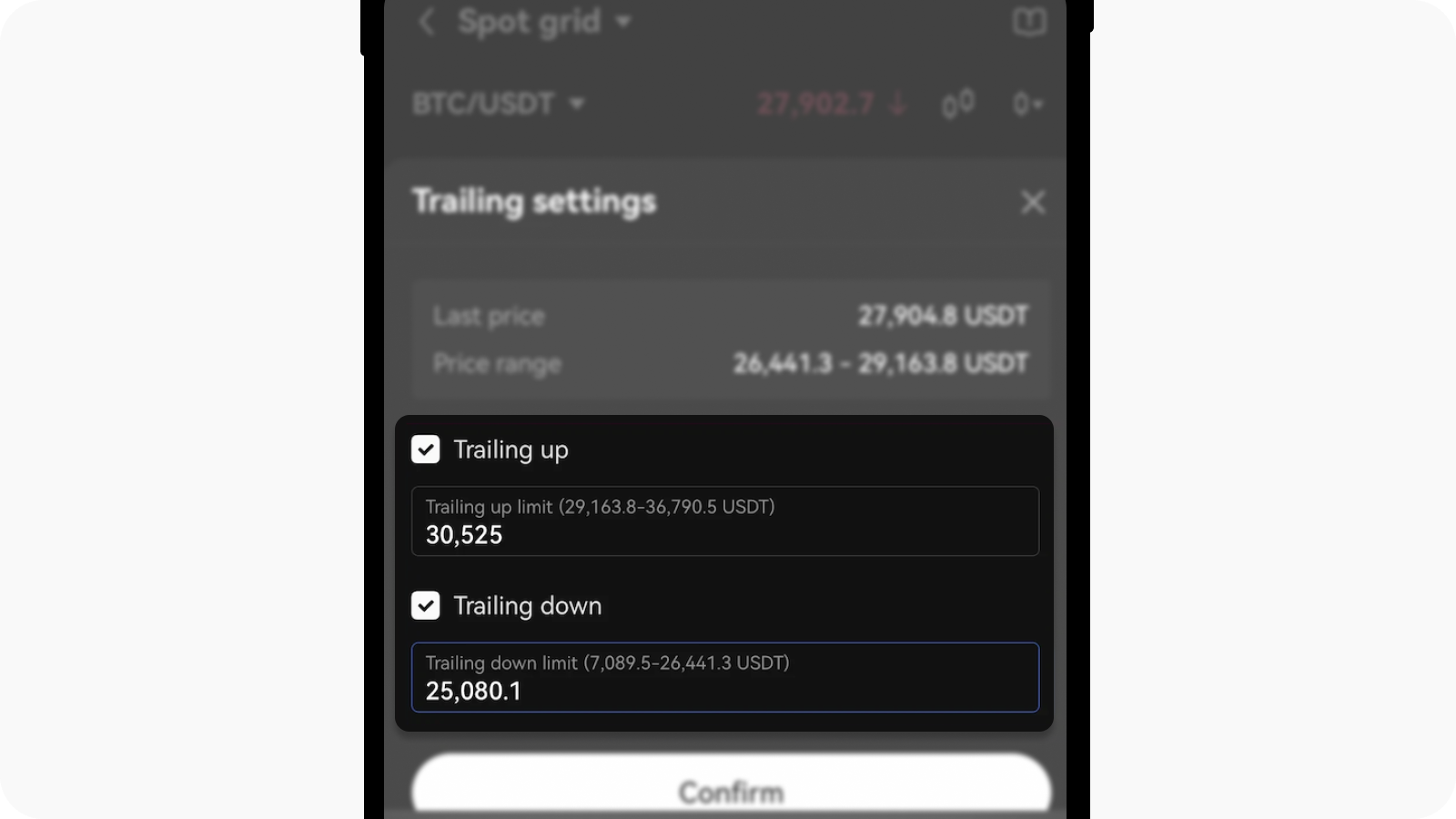

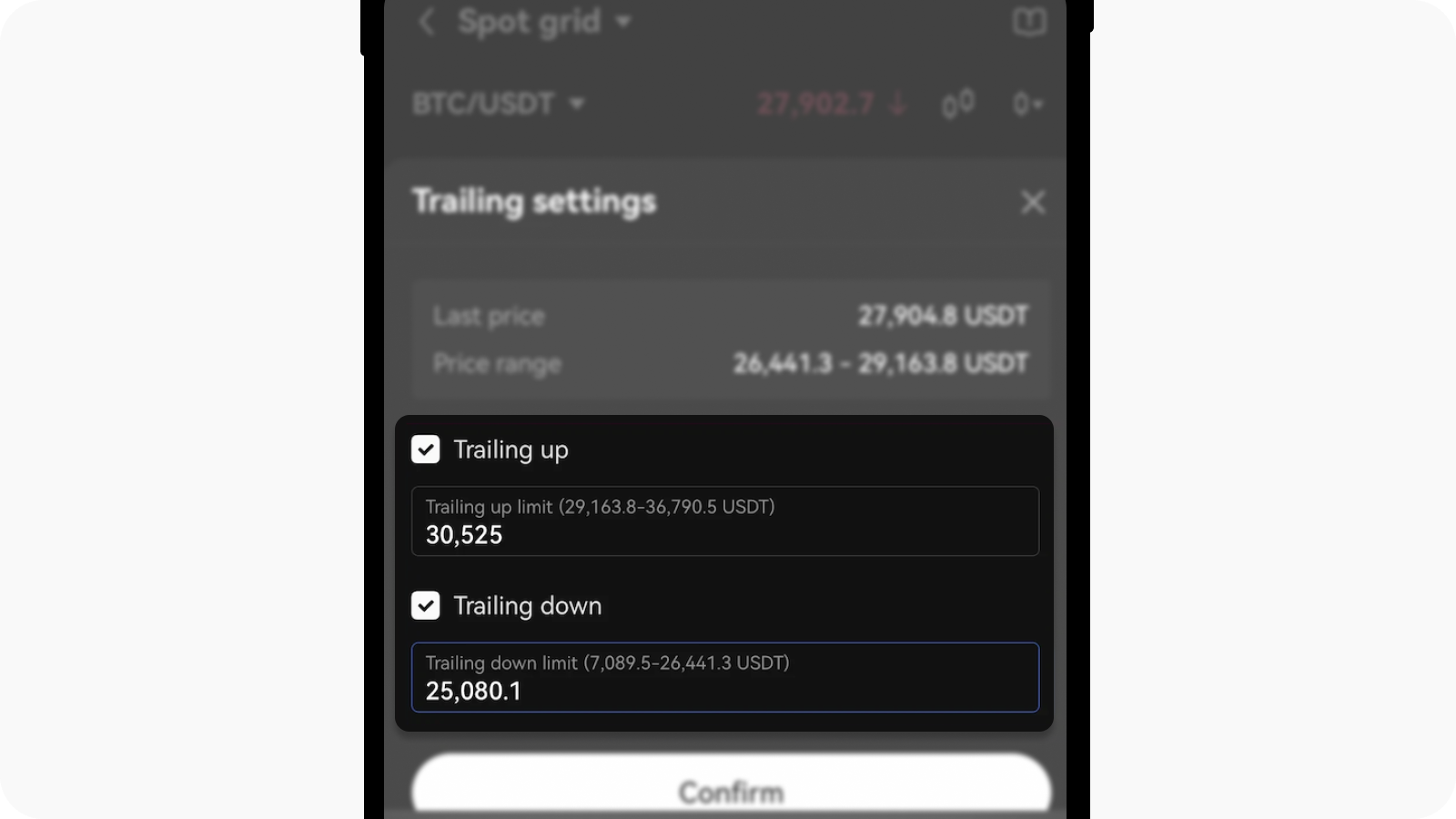

Enable Trailing Settings to activate trailing up and trailing down by simply check the respective boxes. Then, insert a price limit that suits your trading strategy. Once you're done, select Confirm to save the settings

Within the Spot Grid trading bot

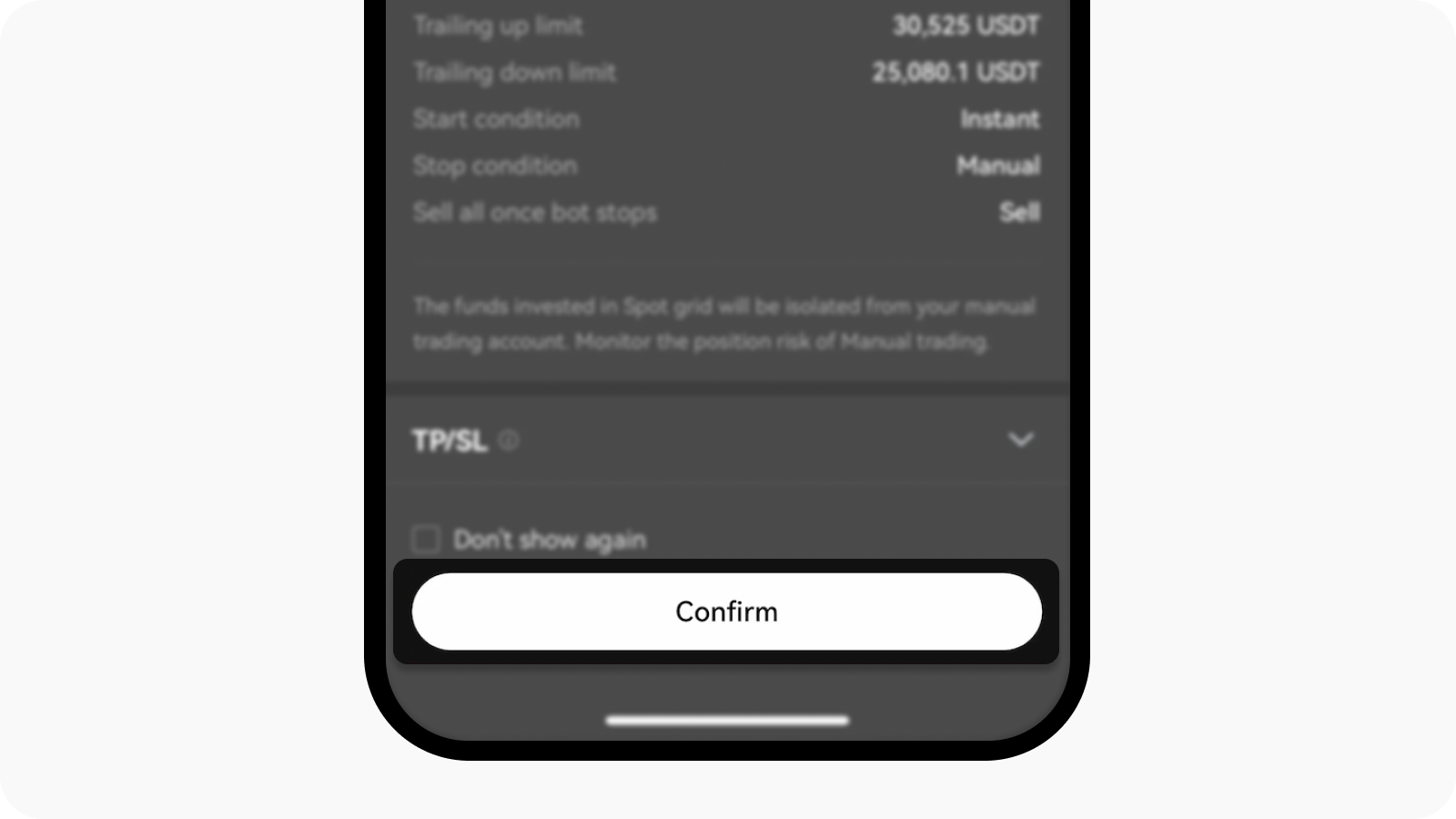

Create and confirm the order: after configuring the trailing settings, select Create to generate the spot grid order. Review the order details, ensuring the trailing settings are correctly set. Once you're satisfied, select Confirm to finalize and execute the order

Confirm your order to carry out complete implementation