Max Transfer Amount with Option Value

When users initiate coin transfers from trading accounts to funding accounts with "Borrowing" switch turned-on, the Max Transfer amounts are calculated differently between accounts in Portfolio Margin mode (PM) and non-Portfolio Margin (non-PM) mode.

Non-PM Mode

In Simple Mode, Single Currency Mode & Multi-Currency Mode, if the net option value in a account is positive, such positive option value is not counted as collaterals for borrowing when calculating Max Transfer amount with auto-borrowing, even though such positive option value is indeed counted as equity. Therefore, positive option values do not increase the limit for transfer out.

PM Mode

For accounts in PM mode, positive net option values are considered as eligible equity to support borrowing and hence increase Max Transfer amounts [Note: net option value in an account equals to sum of value of long options and value of short options].

For the purpose of risk control, the following adjustments are applied to values of long option positions in Max Transfer amount calculation:

Discount due to liquidity: values of all long options are multiplied by a liquidity coefficient. The current value of this coefficient is 0.8.

Discount based on BS Delta: a separate discount coefficient between 0 and 1 is applied to value of each OTM option. The smaller the absolute value of an option's BS Delta, the smaller the coefficient value is. The coefficient is set to 0 for deep OTM options, i.e. deep OTM options can not be used as collateral for borrowing at all.

Upper limit: in each PM account, the sum of values of all long options after adjustments a & b above is further capped at a pre-defined upper limit level. Currently, this limit is set as 1,000,000 USD.

Temporary Switching-off of the Option Value supporting Max Transfer Feature

The feature of option value supporting Max Transfer amount in PM accounts will be temporarily switched off when the system detects abnormal market behaviours in option markets. The risk indicators that can trigger such pauses of features include mark prices abnormality, unusual prices / quantities of bid/ask quotes, etc. In such cases, positive options are no longer counted as collaterals for all PM users; however, they can still perform Transfer actions with Max Transfer limits calculated without considering option values. When the risk indicators turn back to normal, the feature of option value supporting max transfer is reactivated for all PM users.

Note that the potential pauses and reactivations of this feature as mentioned above only affect Max Transfer amounts. Adjusted Equity, In Use & Cross Margin Ratio of PM accounts are not affected.

Related Settings on UI

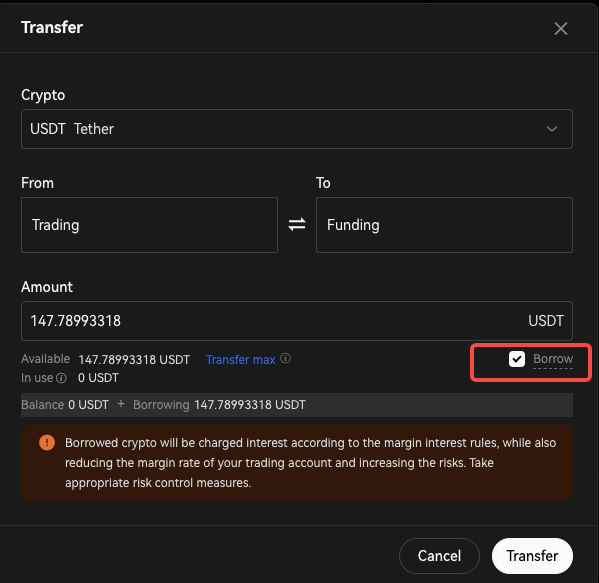

To use the feature described above, a PM user needs to activate "Auto borrow" setting, and also to check "Borrow" in the dialogue box when trying to transfer from the trading account to the funding account (as shown in pictures below, using Web UI as example) .