Tiered maintenance margin ratio rules

What is the forced liquidation rule?

Forced liquidation is the process by which the system automatically handles your risk positions when your position or the margin level of the account reaches the danger line, which is 100% or lower. The specific process includes order cancellation, partial liquidation, and/or full liquidation. The liquidation process of each mode is different. For details, refer to the cross-position trading rules of each mode.

What are maintenance margin requirements, liquidation fees, and liquidation penalties?

Maintenance margin requirements

Isolated margin, spot and futures cross margin, multi-currency cross margin: The maintenance margin of the margin level is calculated by multiplying the value of each position by its corresponding maintenance margin requirements, and then summing the margins from all positions. The maintenance margin requirement is the minimum position margin rate that you are required to maintain for current positions.

In addition, the maintenance margin in portfolio margin mode is not calculated based on the maintenance margin requirement, but is determined based on the loss value under extreme stress test scenarios. For details, refer to Portfolio margin mode: Cross margin trading.

Liquidation fees

When the account/position margin level ≤ 100% in each account mode, the account triggers an automated forced position reduction. A liquidation fee is charged for processing the liquidation order during the liquidation process. It is calculated based on the taker fee rate of your current fee level. (The option liquidation fee is the minimum of the value mentioned above and the value of 12.5% of the option premium.)

Liquidation penalties

An additional fee is collected from your account to bear market fluctuations when processing liquidation orders, including the slippage of processing positions and some liquidation losses. The net profit and loss of these fees will be injected into the insurance fund account to further protect users. Maintenance margin and liquidation penalties are closely related. Refer to the last part of the article for specific rules on when and how these are calculated.

Why and how are tiered maintenance margin requirements calculated?

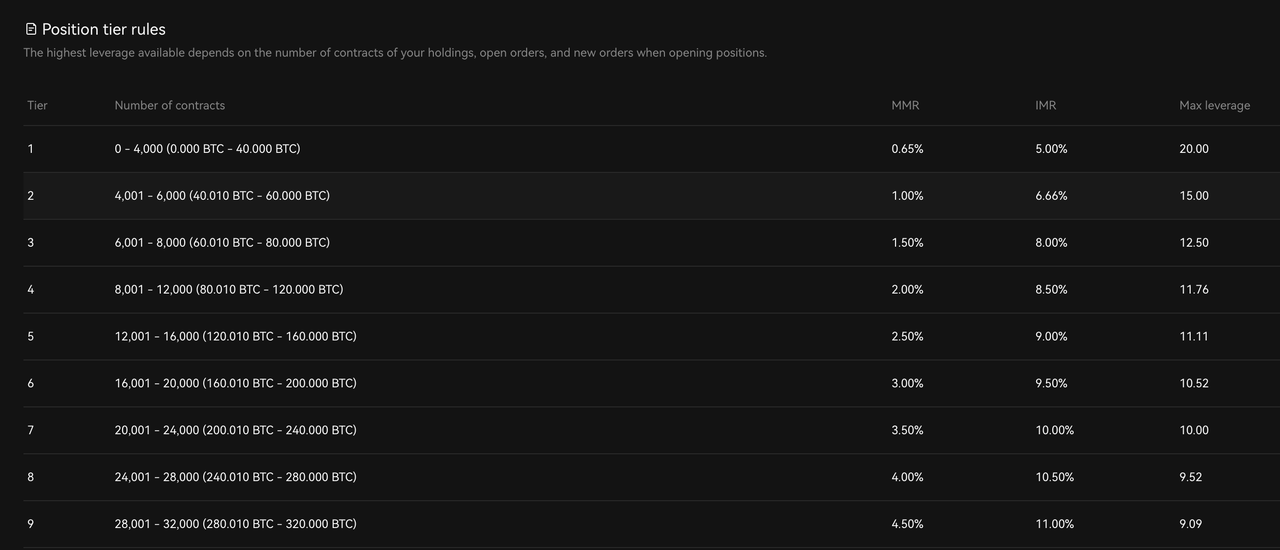

Tiered maintenance margin requirements are implemented to prevent market liquidity from being impacted by the forced liquidation of large positions, which could result in substantial losses from position penetration. The larger your position, the higher the maintenance margin requirement, and the lower the maximum leverage that you can set. For each business line further details are provided below:

Futures Contracts (expiry and perpetual)

Under isolated margin mode, the positions in each direction of each contract are calculated separately for the number of contracts, the tier, and the required maintenance margin requirement for the position.

Under cross-margin mode, the positions in all directions of each contract are calculated together with the number of contracts, the tier, and the required maintenance margin requirement for the position. When you hold multiple contracts for the same cryptocurrency with different expiry dates, the total number will include all of these contracts, regardless of their expiry dates. For example, if you have 1,000 BTC weekly expiry contracts, 500 bi-weekly contracts, 500 quarterly contracts, and 500 bi-quarterly contracts, the total number of contracts is 2,500, which corresponds to tier 2.

The table below shows the maintenance margin requirement for BTCUSDT expiry contracts:

Under cross margin mode, the positions in all directions of each contract are calculated together with the number of contracts, the tier and the required maintenance margin rate for the position. When the user has multiple contracts with expiry dates in one crypto at the same time, the user's total number of contracts will be calculated as all contracts of different expiry dates.

For details of other futures tiers, go to Position tiers.

Margin

The required maintenance margin requirement can be determined through the position tiers based on the amount of borrowed crypto. Among them, you can refer to the corresponding trading pair tiers under isolated margin mode or spot and futures cross-margin mode. For multi-currency and portfolio margin modes, refer to the corresponding crypto tiers.

For details of other margin tiers, go to Position tiers.

Options

The corresponding margin level in the position tiers can be determined based on the number of options. This method is not applicable to cross-positions in portfolio margin mode (applicable to isolated positions). For details of other options tiers, go to Position tiers.

Margin liquidation process

Liquidation of isolated positions and spot and futures cross-margin positions: The system will assume the liability based on the position tiers. It will also collect the necessary amount to repay the liability from the asset and charge liquidation penalties.

Liquidation of the cross-margin positions in multi-currency and portfolio margin accounts:

When the liability is a non-USDT crypto, the system will first address the liability side and reduce the position according to the liquidity, from highest to lowest, while also considering the position tier of the crypto. For positive assets, the crypto with the higher maximum discount rate will be selected to be liquidated first.

When the liability is USDT, the system will start from the asset side and reduce the position in a gradient according to the liquidity from highest to lowest, combined with the currency discount rate level.

What factors determine the liquidation penalties?

For spot and margin

The following units are all cryptocurrencies, and the final liquidation penalty will be reflected in the liquidated assets:

Account mode | Formula |

|---|---|

Isolated mode | Liabilities = ABS (liability amount) × Maintenance margin requirement in position tier of trading pair / Trading pair tiered maintenance margin rate |

Spot and futures cross-margin mode | Liabilities = ABS (liability amount) × Maintenance margin requirement in position tier of trading pair |

Multi-currency cross-margin position and portfolio mode | 1. Assets and liabilities will be charged liquidation penalties, but if one of them is a USDT currency, no liquidation penalty will be charged. |

For futures

The liquidation penalty under portfolio margin mode is also calculated according to this formula:

Type | Formula |

|---|---|

Crypto-margined | Face value × Contract multiplier × Number of liquidated positions / Mark price × Position tier maintenance margin requirement corresponding to the number of positions liquidated |

U-margined | Face value × Contract multiplier × Number of liquidated positions × Mark price × Position tier maintenance margin requirement corresponding to the number of positions liquidated |

For options

The liquidation penalty under Portfolio margin mode is also calculated according to this formula:

C = Configuration item*

Type | Formula | Others |

|---|---|---|

Call option | C × Margin factor × Number of liquidated positions | C = Configuration item |

Put option | Max (C, C × Option mark price) × Margin factor × Number of liquidated positions |

This document is provided for informational purposes only. It is not intended to provide any investment, tax, or legal advice, nor should it be considered an offer to purchase, sell, hold or offer any services relating to digital assets. Digital asset holdings, including stablecoins, involve a high degree of risk, can fluctuate greatly, and can even become worthless. Leveraged trading in digital assets magnifies both potential gains and potential losses and could result in the loss of your entire investment. Past performance is not indicative of future results. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition, particularly if considering the use of leverage. You are solely responsible for your trading strategies and decisions, and OKX is not responsible for any potential losses. Not all products and promotions are available in all regions. For more details, please refer to the OKX Terms of Service and Risk & Compliance Disclosure.

© 2024 OKX. All rights reserved.