Whipsaw refers to a situation where the price of an asset is moving in one direction but suddenly reverses and moves in the opposite direction. A whipsaw can occur when prices are rising or falling, and are typically seen during periods of high volatility. That's why traders in the notoriously turbulent crypto markets would be wise to read up on whipsaws. OKX is here to help.

In this article, we'll walk you through what causes a whipsaw, how to recognize one, and how to react should a whipsaw occur.

TL;DR

A whipsaw is an occurrence in all forms of trading where prices move in one direction but suddenly reverse and move in the opposite direction.

A whipsaw usually arrives suddenly, and can therefore be hard to predict.

Unexpected news events, regulatory changes, and the opinions of influential figures can all cause a whipsaw.

Tools such as Bollinger Bands, Moving Average Convergence Divergence, and volume indicators can point towards a potential whipsaw occurring.

You can potentially minimize the impact of a whipsaw by using a wider stop-loss, applying less leverage, and focusing on high liquidity assets, where volatility is usually lower.

What usually causes a whipsaw event?

The causes of a whipsaw aren't always easy to predict, making it challenging for traders to anticipate the sudden price reversal. However, historical price action has shown us what macro events can create the conditions for a whipsaw to occur in.

Unexpected news events

Virtually all active traders will make decisions based partly on news headlines, given the media's influence on trader sentiment. As a result, an unexpected economic event hitting the headlines can cause a flurry of positions to open, causing the price movement of a particular asset to halt and move in the opposite direction.

We can look to pandemic-era data for an example of a crypto whipsaw caused by a macro event. March 12, 2020 saw a major price crash for Bitcoin. As the pandemic deepened, traders rushed to liquidate their positions, fearing an economic downturn. The sudden sell-off brought prices down as low as $4,805, amplified by the forced liquidation of leveraged positions. As prices bottomed out, many saw it as the ideal moment to buy the dip, causing BTC to rebound as high as $5,581 just 24 hours after the crash. The whipsaw likely caught many short sellers out who expected prices to continue falling.

Regulatory announcements

Because crypto's regulatory landscape is still taking shape globally, many traders believe that regulators have an outsized influence on market movements compared to other trading vehicles. As such, an announcement from a nation's regulator could cause traders to react in anticipation of others opening a similar position, creating a whipsaw event. The challenge here is that announcements typically arrive without warning, making it difficult for traders to react in time to avoid a loss.

Geopolitical shifts

Another potential cause of a whipsaw event are geopolitical shifts. Conflict or political tension can create a risk-on environment, where traders become more fearful and therefore exit higher-risk assets such as cryptocurrencies. The sudden liquidation of an asset can cause its prices to drop quickly, causing a whipsaw moment if prices were trending higher up until that moment. Keep in mind that the opposite is also true. Although it wasn't strictly a whipsaw event, the rise of Bitcoin to a new all-time high on the day of the 2024 U.S. presidential election spotlights the power of geopolitical events in influencing crypto prices.

Opinion of influential figures

Many traders recognize the power of opinion over crypto prices, especially those of influential figures in the space. DOGE and Elon Musk are a helpful example. The entrepreneur once claimed that Dogecoin was his favorite cryptocurrency, leading many traders to become reactive to his public statements about the token. For example, during an appearance on U.S. late-night comedy show Saturday Night Live, Musk called DOGE a "hustle", causing the asset's value to plunge by 30%.

How to identify a whipsaw

Now that we know what can cause a whipsaw, how do you identify one? In the simplest terms, a whipsaw can be identified by a sharp reversal in price action, often during a period of high market volatility. Meanwhile, high trading volume can also indicate whipsaw conditions, as traders flood the order book with new positions in response to whatever stimulation has caused the initial price reversal.

Technical indicators can also be helpful in confirming a whipsaw event, and more importantly, gaining insight to help you decide your next move. Let's look at some of the indicators you can lean on.

Moving Average Convergence Divergence (MACD)

Because a whipsaw involves a sudden change of momentum for an asset's price, traders can use the Moving Average Convergence Divergence (MACD) indicator to spot a trend reversal as it happens. That's because MACD is considered a momentum-based trading indicator. Not only can the MACD indicator be used to spotlight a potential whipsaw, it also points to the potential strength of a new trend line. Helpfully, MACD provides a visual representation of a trend reversal through a histogram, which is shown by measuring the difference between an MACD line and a signal line.

Volume indicator

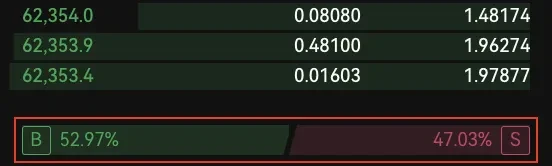

Studying the trading volume of an asset is another way of identifying a whipsaw. Here, you can check the order book to quickly see the buy and sell volume of the asset in question. The volume is usually represented as a percentage at the bottom of the order book, as the example above from OKX shows. If the difference in buy or sell volume is high in either direction, it could point to conditions where a whipsaw might occur. This is especially true if volume momentum suddenly shifts in the opposite direction.

Support and resistance levels

Support and resistance provide a relatively simple measure of a potential whipsaw in progress. Both support and resistance levels indicate a price area where traders expect buying or selling pressure to become exhausted. As such, this is where traders often place buy or sell orders to enter a position at the right moment, just before prices reverse. However, a situation where prices break through support or resistance with relative ease could point to a potential whipsaw.

Bollinger Bands

Bollinger Bands are another tool to help identify a whipsaw, as they're often used to measure volatility and spot possible price reversals. Bollinger Bands consist of three bands — an upper, middle, and lower band. As the upper and lower bands represent boundaries for price movements, any price action that moves beyond these bands in a possible breakout before quickly reversing could point to a whipsaw occurring.

How to trade during whipsaw conditions

Although a whipsaw can be difficult to predict and sometimes even appear out of nowhere, there are steps you can take to trade cautiously if you suspect a whipsaw is likely to occur.

Focus on high liquidity assets

Because a whipsaw is often encountered during periods of high volatility, you can reduce the risk of encountering one by focusing on assets with high liquidity. Higher liquidity typically brings more stable prices when compared to low liquidity situations, as buyers and sellers can be more easily found across price points, and slippage is limited. These factors can reduce the chances of encountering a whipsaw, but not entirely.

Use a wider stop-loss

The stop-loss is an essential risk management tool crypto traders lean on to limit their potential losses, particularly during periods of high volatility. During whipsaw conditions, many traders will widen their stop-loss to protect their position without suffering from unwanted liquidation should prices suddenly move against them, as is the case with a whipsaw. A wide stop-loss can help you ride out a whipsaw period and stay in the trade.

Apply leverage wisely

Although leverage can bring you larger gains, there's also the risk of bigger losses should prices move against your position. Because whipsaw conditions typically bring greater volatility, it's wise to carefully consider the amount of leverage you're comfortable applying, and leaning on the side of caution. It may be best to apply no leverage at all and instead be comfortable with more modest gains if it means preserving capital to trade another day. Ultimately, this decision comes down to your risk appetite. As always, we recommend never trading with more than you can afford to lose.

Consider a longer time horizon

One advantage long-term holders have over day traders is that their strategy can help mitigate the risk of a whipsaw. If a trader is strong enough to stay the course and hold their assets even through wild swings in price action, they may eventually emerge with gains made, rather than selling at the first sign of a loss. By considering a longer time horizon if your trading strategy allows it — and sticking to it, most importantly — you can potentially ride out a whipsaw and emerge in a stronger position than before.

The final word

A whipsaw is another important consideration for crypto traders as you learn to navigate the market's inherent volatility and adjust your trading strategy to suit the changing conditions. Although a whipsaw can appear suddenly, there are steps you can take to spot one as it forms and minimize the risk to your portfolio.

FAQs

The only way to avoid a whipsaw is to not trade at all. A whipsaw can arrive suddenly with little warning, but technical analysis tools such as Bollinger Bands and Moving Average Convergence Divergence can be used to help you spot a whipsaw event emerging. To reduce the risk of a whipsaw, it's key to apply careful risk management and never trade with more than you can afford to lose.

High volatility, high trading volume, and a sharp reversal of price action can all point to a whipsaw. Look to the trading volume of an asset in the order book and apply tools such as Bollinger Bands and the Moving Average Convergence Divergence to help spot a whipsaw.

Generally, it's riskier to trade when a whipsaw is seen because volatility is higher and the markets become harder to predict. You must trade with caution during volatile periods because your assets are at risk.

Gains are possible from a whipsaw should you accurately predict price movements. However, this becomes much harder because of the added volatility in the market. That's why you should never trade with more than you can afford to lose.

© 2024 OKX. Niniejszy artykuł może być powielany lub rozpowszechniany w całości lub we fragmentach zawierających maksymalnie 100 słów, pod warunkiem, że takie wykorzystanie jest niekomercyjne. Każda reprodukcja lub dystrybucja całego artykułu musi również zawierać wyraźną informację: „Ten artykuł należy do © 2024 OKX i jest używany za zgodą”. Dozwolone fragmenty muszą odnosić się do nazwy artykułu i zawierać przypisanie, na przykład „Tytuł artykułu, [nazwisko autora, jeśli ma zastosowanie], © 2024 OKX”. Żadne prace pochodne ani inne sposoby wykorzystania tego artykułu nie są dozwolone.